The Ministry of Finance (MoF) announced the implementation of the Sales and Service Tax (SST), to be administered by the Royal Malaysian Customs Department (RMCD), effective September 1, 2018.

Following the abolishment of the 6% Goods and Services Tax (GST), the reintroduction of SST 2.0 took effect on September 1, 2018. Prior to the implementation of the GST in 2015, Malaysia imposed Sales Tax and Service Tax. Governed by the Sales Tax Act 2018 and the Service Tax Act 2018, Sales Tax was a federal consumption tax applied to a wide range of goods, while Service Tax was levied on customers using specific taxable services. Certain designated areas, such as Langkawi Island, Tioman Island, and Labuan Island, were exempt from the Service Tax. This overview aims to provide clarity on the nature of SST and its implications.

Increase in Service Tax rate

Starting from March 1, 2024, the service tax rate will rise from 6% to 8% for all taxable services, with the exception of food and beverage services, telecommunication services, parking services, and logistics services (which are newly classified as taxable services).

Transitional from GST to SST

When the GST Act 2014 is repealed, individuals automatically cease to be GST registered persons without needing to apply for deregistration. However, they must submit their final GST return within 120 days from the repeal of the Act, which is by December 28, 2018.

Following September 1, 2018, Customs audits for GST closure purposes will be conducted on GST registered entities.

Companies are required to file SST returns (SST-01) bi-monthly, within the last day of the following month after the taxable period ends.

Manufacturers/Service Providers who were previously GST Registered Persons and meet the necessary criteria will be automatically registered as Registered Manufacturers under Sales Tax or Registered Service Providers under Service Tax. They must begin charging tax from September 1, 2018.

GST registered individuals who meet the criteria for registration but were not registered by September 1, 2018, must apply for registration through the MySST system within 30 days from the commencement date.

Registration is automatically approved within 24 hours for GST registrants. If a verification process is necessary, it will take longer processing time.

For more detailed information, specific SST industry guides can be downloaded from the Customs Website.

Malaysia Service Tax 2018

Malaysia’s Service Tax is an indirect tax applied to taxable services provided in the course of business by a taxable person within Malaysia. Notably, Service Tax is not applicable to imported or exported services.

An update to the taxation system involves imposing Service Tax on imported services to prevent local service providers from facing unfair competition with foreign counterparts. This implementation will occur in two phases: services imported by Malaysian businesses from January 1, 2019, and services imported by Malaysian consumers from January 1, 2020.

Under the Service Tax Act 2018, service providers are required to register for Service Tax if the value of taxable services provided over a 12-month period exceeds the threshold of RM500,000. However, for operators of certain businesses like restaurants, caterers, and food court operators, the registration threshold is RM1,500,000.

The Service Tax rate is set at 6%, with a specific tax rate of RM25 imposed upon issuance of principal or supplementary cards, and annually thereafter.

The following taxable services are subject to the service tax:

Hotel (include lodging house, service apartment, homestay, Inn, rest house, boarding house)

Insurance and Takaful

Service of food and beverage preparation (include restaurant, cafe, catering, take-away, food truck, retail outlet, hawkers and etc)

Club (include Night club, private club, golf club)

Gaming (include Casino, game of chance, sweepstakes, gaming machines, lottery, betting)

Telecommunication

Pay-TV

Forwarding agents

Legal

Accounting

Surveying

Architectural

Valuer

Engineering

Employment agency

Security

Management services

Parking

Motor vehicle service or repair

Courier

Hire and drive car

Advertising

Domestic flight except Rural Air Services

Credit or charge card

IT services

Electricity

However, the service tax cannot be levied on any services that are not in the list of taxable service.

Accounting Basis for Service Tax

Companies are mandated to prepare their SST return on a payment basis for Service Tax purposes. This entails accounting for Service Tax upon receiving payments or within twelve months from the invoice date if the full payment is not received.

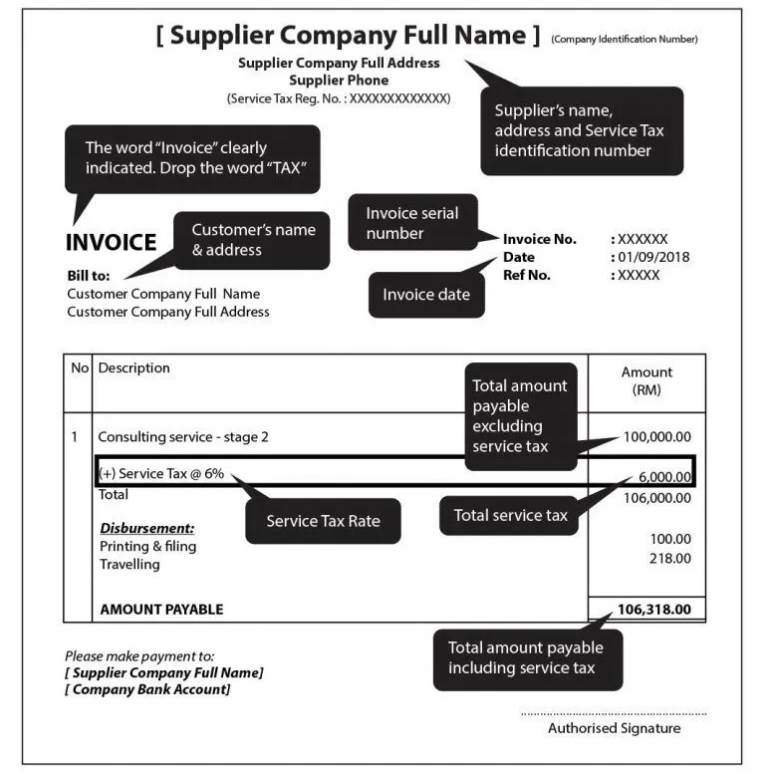

Service providers are required to issue invoices containing the prescribed particulars, which can be in hardcopy or electronic form and in either Bahasa Melayu or English. Credit or debit notes issued should be reflected in the SST return.

Both registered and ceased-to-be-registered persons can claim bad debts within a timeframe of 6 months to 6 years from the date the service tax was paid, subject to approval from the Director General (DG). If bad debts are recovered after a refund has been received, the registered person must reimburse the service tax refund to the DG in their return.

Businesses are obliged to retain their records in Malaysia for a period of 7 years. However, approval from the DG is necessary for record-keeping overseas. Records can be maintained in either softcopy or hardcopy format.

Sample Invoice for Service Tax

Malaysia Sales Tax 2018

The Sales Tax, a single-stage tax, is imposed at the import or manufacturing levels in Malaysia. It is mandatory for all manufacturers of taxable goods to be licensed under the Sales Tax Act 2018. The government collects Sales Tax only at the manufacturer’s level, and this tax is embedded in the price paid by the consumer.

Companies, including manufacturers or subcontractors, whose sales value of taxable goods exceeds RM500,000 within a 12-month period are required to register under the Sales Tax Act 2018.

Goods not exempted through the Proposed Sales Tax (Goods Exempted From Sales Tax) Order are subject to sales tax at varying rates, typically ranging from 5% to 10%. However, sales tax for petroleum is charged at a specific rate different from other taxable goods.

Certain manufacturing activities are exempted from SST registration, including tailoring, installation incorporation of goods into buildings, and jeweler and optician services.

Accounting Basis for Sales Tax

Companies are required to prepare their SST return on an accrual basis for Sales Tax purposes. This means that Sales Tax must be accounted for at the time when the goods are sold, disposed of, or first used.

Companies selling taxable goods must issue invoices containing the prescribed particulars. These invoices can be in hardcopy or electronic format, and they may be in either Bahasa Melayu or English. Any credit notes and debit notes issued must be accounted for in the SST return.

Registered manufacturers or those who have ceased to be registered manufacturers can claim bad debts within 6 years from the date the taxable goods were sold, subject to the conditions and satisfaction of the Director-General (DG). If bad debts are recovered from the debtor after the claim has been made and the sales tax refund has been received, the registered manufacturer must repay the sales tax refund to the DG in their return.

Businesses are required to keep their records in Malaysia for 7 years, although approval from the DG is needed for record keeping overseas. Records can be maintained in either softcopy or hardcopy formats.

Sales and Service Tax (SST): Boon or Bane?

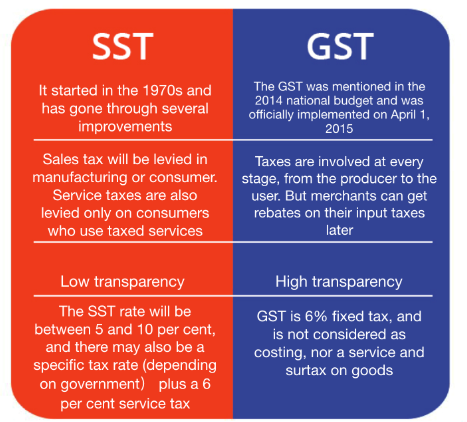

The government’s decision to reintroduce Sales and Services Tax (SST) has sparked varied opinions, prompting a need to understand the disparities between SST and the existing tax system, GST, along with their implications.

SST and GST both fall under the category of consumption taxes. However, SST operates as a single-stage tax, while GST functions as a multi-stage tax applied at every stage of the supply chain for goods and services. The SST imposes rates of 10% for sales tax and 6% for services tax, levied solely at the final production and service stages. Compared to GST, SST encompasses a narrower range of taxable items and exemptions.

In contrast, GST is uniformly applied at every stage of the supply chain, including suppliers, manufacturers, wholesalers, and retailers. It features a broader scope of exemptions and taxable items, encompassing all goods and services unless classified as exempted items, such as essential goods, healthcare services, and public transport.

Key Takeaways:

The SST is levied at the consumer end while the GST is paid by all companies.

The SST is payable when consuming good while GST is payable on every transaction between companies before reaching the end consumer.

The Sales Tax will only be imposed on the manufacturer or consumer level, while the Service Tax is taxed on consumers that are using tax services.

The GST, which stands at a flat rate of 6%, while the SST rates vary from 5-10% to specific rates.

The GST covers everyone, while the sales tax only covers manufacturers and services tax covers certain prescribed services like professional services.